Ambiki Billing Guide

Need help getting started? Review the following information for guidance on how to get started with billing on Ambiki.

Request a DemoBilling Overview

Introduction

Ambiki's billing product is comprehensive and flexible, enabling your practice to easily manage all your billing needs. Whether it involves insurance billing, private payments, or direct invoicing to facilities such as school systems, this guide will equip you with the necessary knowledge.

Key Concepts

It's important to grasp some fundamental concepts of Ambiki billing. Understanding these key concepts will streamline your billing process, making it straightforward and efficient.

Ambiki Functionality and What We’ll Cover in This Guide

-

Insurance Billing - Do you accept commercial insurance, Medicaid, or Medicare?

- Clearinghouse Setup: Our expert team will guide you in setting up or connecting your clearinghouse account.

- Claim Submission Enrollment (EDI 837P): Our billing team can help you enroll with your payers for claim submission.

- ERA Enrollment (EDI 835): Our billing team can also assist with enrolling in Electronic Remittance Advice.

- Setting Up Payers: Guidelines for adding and managing insurance companies on Ambiki.

- Setting Up Rates: Establish rates for the services you bill and the rates you pay your therapists (for payroll).

- Sending Claims: Explore options for automatically or manually sending claims.

- Multipayer Claims: How to manage claims involving multiple payers.

- Correcting Claims: Best practices for amending submitted claims.

- Matching (Posting) of ERA Claims: Ambiki automatically matches your ERAs back to the original invoice. For claims submitted outside of Ambiki, instructions on how to manually match them are provided.

- Ledgers and Accounting: Essential tips for maintaining accurate financial records.

- Copayments and Patient Responsibility Amounts: How to manage and record patient payments.

-

Private Payments - Do your clients pay 100% out-of-pocket for your services?

- Accepting Credit Cards through Stripe: Learn how to integrate and process payments via Stripe.

- Logging Payments Handled Outside of Ambiki: Tips for recording external transactions.

- Creating Superbills: A superbill is a detailed form used by healthcare providers that outlines the services provided to a patient. It is essential for patients who visit out-of-network providers and need to submit their own insurance claims for reimbursement.

-

Facility Invoicing - Do you have a contract with a school or daycare that requires invoicing?

- Setting Up Rates: Define rates for the services you bill, as well as the rates you pay your therapists (for payroll).

- Logging Services Performed: Best practices for accurately recording services.

- Generating Invoices: Steps to create and send invoices to facilities.

Terminology

Before diving deeper into Ambiki billing, it is important to align on key terminology.

4 Important Concepts in Ambiki and How They Differ

- Event: In Ambiki, an "event" refers to what you schedule, commonly known as an appointment. The event includes details such as the time, place, patient, and therapist involved in a session.

- Visit Note: Captures the clinical details of a session. This document is essential for recording the observations, assessments, and clinical decisions made during a patient's session, providing a continuous record of their care.

- Treatment Report: Details the services provided during a session. A single treatment report can be associated with multiple invoices. For instance, one service might be billed to Insurance Company A while another service is paid for in cash. Alternatively, a single service could be billed to multiple payers—such as first to a primary insurer who pays nothing, then to a secondary insurer.

- Invoice: Captures the amounts due for one or all services listed in a treatment report. Invoices are generated based on the services documented in the treatment report and reflect the financial transactions that need to occur.

Why are these four separate concepts? For instance, why can't the treatment report and visit note be combined into a single concept?

Well, everyone uses Ambiki differently, and the system needs to be flexible to accommodate a wide variety of use cases. For example, some practices might use Ambiki solely for billing and not engage in clinical documentation, which means they would only generate treatment reports without any associated visit notes. Conversely, other practices may do their clinical documentation in Ambiki but not handle billing. Most practices, however, will require both.

Other Important Terms

- Claim: The invoice or bill you submit to an insurance company. It includes information such as the NPI of the treating clinician, ICD-10 diagnosis codes, CPT procedure codes, and the patient's insurance details.

- Clearinghouse: An intermediary between you and the insurance company, required by most insurance providers. It checks claims for accuracy and forwards them to insurance companies through a process called ‘claims scrubbing’.

- Copayment (Copay): A fixed fee that the patient pays the healthcare provider for services or treatment received. This flat fee is due at the time of the visit. Some plans allow this fee to apply toward the deductible, while others do not.

- Electronic Data Interchange (EDI): A link between your billing system and the insurance company, facilitating the transfer of claim data to various insurance payers.

- EDI Enrollment: The process of enrolling with a clearinghouse and/or individual payers to submit electronic claims. Certain payers, including Medicare and Medicaid, require enrollment paperwork before you can submit claims to them via the clearinghouse.

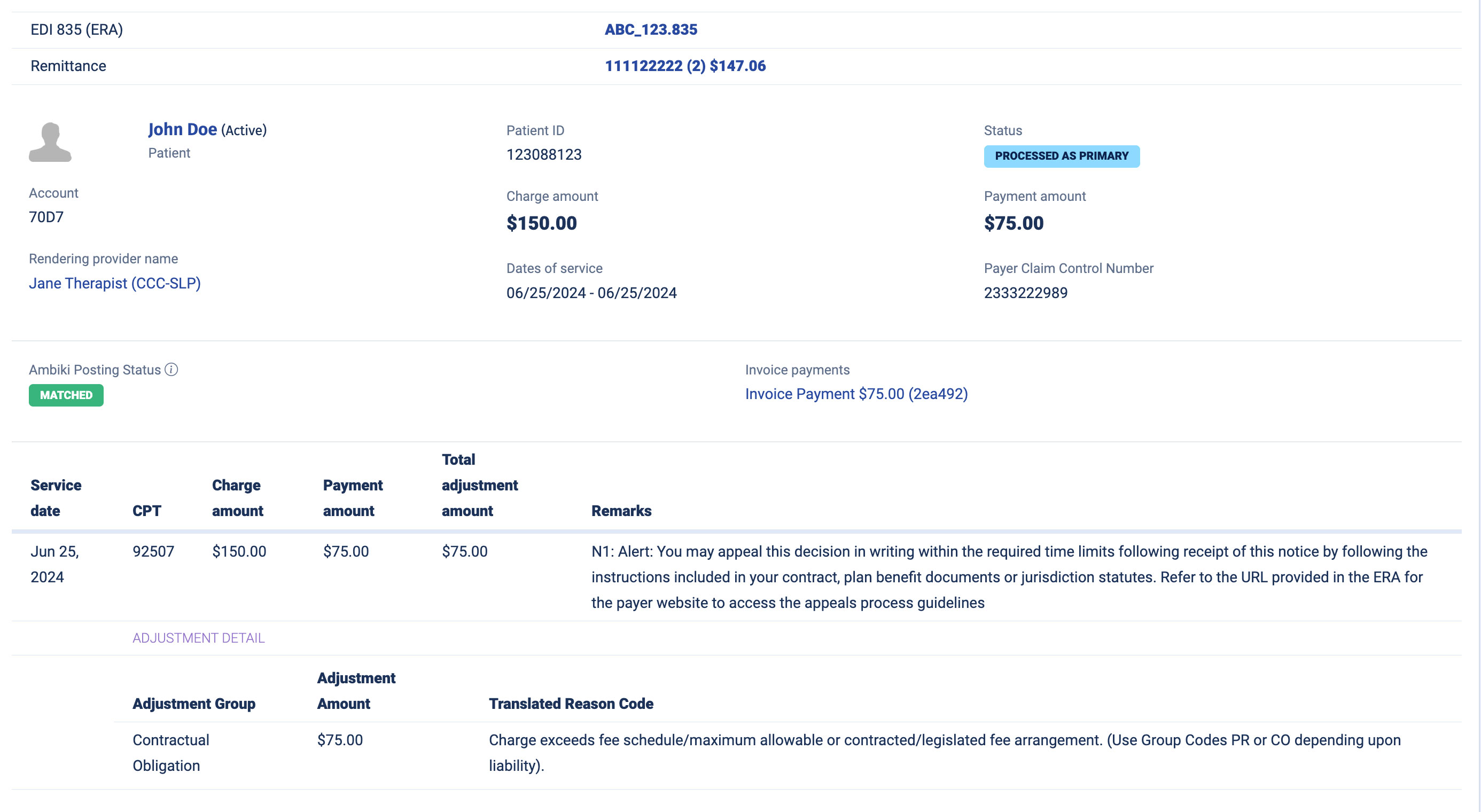

- Electronic Remittance Advice (ERA): An electronic data interchange (EDI) transaction that provides claim payment information. ERAs are often used to auto-post claim payments into the billing system. They include information from the insurance company about why a claim was or was not accepted, serving as an electronic form of an Explanation of Benefits (EOB).

- Facility: An entity such as a school district, school, daycare, nursing home, etc., with which your practice holds a contract to provide services. This term refers to third-party entities where groups of patients receive services, rather than individual patients themselves.

- Facility invoicing: The name of the feature that facilitates generating invoices for a district, school, daycare, or other third-party clients of the practice (excluding the direct patient receiving services). This invoice includes services provided during the invoicing period and will be paid by the facility as per the agreed rates in the contract with that facility.

- Payer ID: A unique identifier assigned to each insurance company or payer. This identifier is used in electronic transactions to specify the insurance company responsible for the payment of a claim. Payer IDs are critical in healthcare EDI transactions, such as claims submissions, remittance advice, eligibility inquiries, and claim status inquiries, ensuring that the data is sent to and processed by the correct entity.

- Superbill: An itemized document that outlines the services a patient received from the provider. Patients may use superbills to seek reimbursement from insurance companies when the provider is out of network or the patient pays out of pocket. The superbill serves as proof of service and payment for reimbursement purposes.

First Steps with Insurance Billing

Before you can start insurance billing on Ambiki, you'll need assistance from our expert team to get set up. We'll ensure you are connected with a supported clearinghouse, enrolled for electronic claim submission with the payers to whom you'll be submitting claims, and enrolled to receive Electronic Remittance Advices (ERAs) electronically back into Ambiki from those payers. Our team will work closely with you through this process.

Additionally, you'll need to establish all of your service rates for these insurance companies, and ensure that your patients in Ambiki have the correct payment methods added. The below guides can help you with these steps.

Setup

| Set Up Provider Information and Default Service Rates | View |

| Set Up Insurance Companies | View |

|

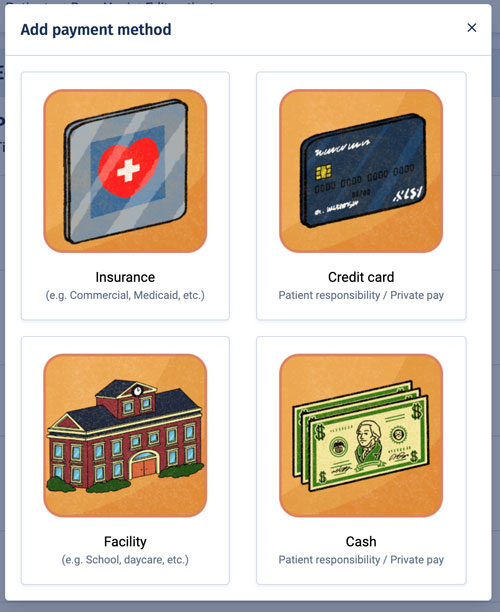

Add Patient Payment Methods

Warning - Common Pitfall! Any patient on Ambiki that is private pay OR has some sort of patient responsibility amount will need a separate payment method where the billable party is the patient themselves. |

View |

| Add Patient Credit Card and Insurance | View |

| Add Insurance Authorizations | View |

| Set Up Billing Modifiers | View |

Customize Your Settings

| Default Service Rates vs Insurance Service Rates | View |

| EMR Settings – Turn on Automated Insurance Billing | View |

| EMR Settings – Insurance Billing Settings | View |

Typical Workflows

After you have completed all of your setup, insurance billing becomes easy. Let's walk through some typical workflow examples.

General Billing Workflow

The general billing workflow FAQ explains all you need to know for all insurance or private pay billing. Refer to the Facility Invoicing section below for additional information not contained in this section.

Patient with a copayment

First, ensure you have your payment methods correctly set up for the patient. On the insurance payment method, be sure to add in their copayment and ensure that payment method is both active and has correct start and end dates (the end date is optional - you can leave it blank if you don't know it or if that payment method doesn't expire). Don't forget that you also need to add a payment method billable to the patient for the patient responsibility amount (choose either 'Credit card' or 'Cash' when adding the new payment method). Also ensure that this payment method is active and has correct dates.

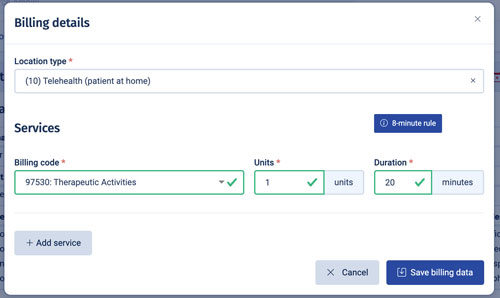

Next, the therapist will have a session with that patient and write a visit note. After saving the visit note, they'll click "Actions -> Billing" and complete any missing info (Ambiki will try to prepopulate these details as best as possible).

Upon completing this billing information and signing the visit note, a treatment report will be generated.

Based on the patient's payment methods, one or more invoices may be created. Ambiki will generate invoices for active payment methods available on the treatment date of service.

For example, in the case of a patient with a copayment, an invoice billable to that patient for the copayment amount will be immediately generated. Additionally, an invoice billable to the insurance company will also be generated.

Depending on your automation settings in Ambiki (under your EMR settings), the system will either send the claim automatically if it passes all necessary checks, or you can choose to manually send claims. If set to manual, you can navigate to the treatment report to send the claim when you are ready.

If claim creation cannot proceed due to missing key information (e.g., NPI number, referring provider, etc.), Ambiki will alert you to the missing information so that you can add it and reload the claim file.

Later—often a week or two—the ERA will be returned. Ambiki will automatically receive this ERA from the clearinghouse, post it, and match it back to the original invoice. If there are any additional patient responsibility amounts (beyond the copayment), Ambiki will generate new invoices billable to the patient for these amounts.

Patient with multiple insurance payers

It is very common for patients to have multiple insurance payers. Ambiki can handle this. For example, a typical situation might be a primary commercial insurance and a secondary Medicaid payer.

In this case, you'll follow all of the same steps as above, ensuring you have all of the payment methods set up with the correct sequence numbers (you can have the payment method billable to the patient set as the last in the sequence).

The first claim will go out to the primary payer. You don't need to do anything extra (i.e. don't manually create an invoice for the secondary payer - Ambiki has it under control). When the ERA comes back from the primary payer, Ambiki will automatically generate the invoice for the secondary payer and prep the claim. If the claim is generated cleanly, it will be automatically sent off.

Warning - Common Pitfall!

Do not attempt to alter or delete invoices while multipayer claims are outstanding or in process. Ambiki's automations have everything under control.

One common pitfall is when the primary ERA comes back, it might include a patient responsibility amount. Some users mistakenly think this is an error because they know this patient has no patient responsibility amount, given that the secondary payer is Medicaid. As a result, they might delete this invoice. Do not do that! Ambiki will automatically adjust the invoice when the secondary ERA comes back, indicating that Medicaid has covered the patient responsibility amount.

When the secondary ERA comes back, Ambiki will make all necessary adjustments based on the details of the secondary ERA - including zeroing out any patient responsibility amounts that may have been covered by the secondary payer.

FAQ - Why does my patient's ledger show a balance when I know that they are covered by Medicaid and do not have a patient responsibility amount?

For patients with multiple payers, a patient balance may be reflected in the period between when the primary ERA is received and the secondary ERA is still outstanding. This occurs because the primary ERA indicates a patient responsibility amount. Until Ambiki receives the secondary ERA, which negates this patient responsibility amount, it must be recorded from an accounting perspective. There is always a chance that the secondary coverage will not cover that amount, for instance, if the patient's Medicaid coverage has lapsed.

Common Processes

| Bill Insurance, Private Pay, or Combination Insurance and Private Pay (e.g., Insurance Payment and Patient Responsibility) | View |

| Bill a Session | View |

| Add a Write-Off | View |

| Customize Treatment Modifiers and Make Edits to Treatment Reports | View |

| Claim Replacement | View |

| Claim Cancellation | View |

| Resubmitting a Rejected Claim | View |

| Reinvoicing a Treatment Report | View |

Private Payments

Ambiki integrates with Stripe, empowering you to accept credit card payments from your clients directly on Ambiki. You can securely enter and store the client’s credit card information by inputting it into the patient profile, or the parent/guardian can use Ambiki’s Patient Portal to enter (and securely store on file) the credit card information themselves.

Ambiki does not charge any processing fees on top of Stripe’s fees.

| How Do I Set Up Stripe? | View |

| How to Bill a Private Pay Source | View |

| Generate a Superbill | View |

| View a Superbill in the Patient Portal | View |

Facility Invoicing

Facility invoicing is used in cases where you do not receive payment through a patient's insurance and are not paid directly by the patient themselves. A common scenario is when a practice has a contract with a school system to provide services to children in that school. In such cases, the school pays the practice for the services provided. Practices need a method to record services and invoice the school or district they are contracted with.

Ambiki offers the functionality to set up all the various services and rates, allows therapists to record the services they provide on a daily basis, and provides a way to generate customizable invoices that can be printed and sent to the facility.

| Log a Facility Invoice for a Treatment Done in a Facility | View |

| Generate a Facility Invoice | View |

Frequently Asked Questions

Q: What is a Payer ID for an insurance company?

A: It is a specific ID (generally 5 digits in length, and can alpha, numeric or a combination of both) that is assigned to an insurance company for electronic communication with the payer/clearinghouse. For example, the payer ID for Cigna is 62308. The Payer ID is mandatory to submit claims and retrieve ERAs for EDI connections through Ambiki.

Q: Where can I find the Payer ID?

A: It is generally found on the back of a patient ID card. If you do not see it there, you can always call your insurance company and ask for it from the Claims department or their EDI department.

Q: What EDI transactions can I do in Ambiki?

A: Claims (837P) and ERAs (835).

If you send claims and enroll to receive ERAs through Ambiki directly, Ambiki will populate this information into your ledgers automatically.

If you send claims or receive ERAs outside of Ambiki (e.g., payer portal, personal clearinghouse account, via mail, etc), you will need to input this data manually into Ambiki for bookkeeping.

Q: What EDI transactions should I do outside of Ambiki (e.g., payer portal, my personal clearinghouse account, etc)?

A: Anything else-- some people use outside tools for eligibility checks, prior authorizations, etc. This information can still be stored manually in Ambiki for your own recordkeeping.

Q: Can I use my personal clearinghouse account to send claims and ERAs through Ambiki?

A: You can only receive ERAs from one clearinghouse at a time per payer. If you would like claims and ERAs to be posted automatically to Ambiki, you must enroll to use our clearinghouse connection and bill directly from Ambiki.

For enterprise clients who already have a clearinghouse connection set up, please inquire as we may be able to support your current clearinghouse.

Q: Can I submit claims when using the Trial version of Ambiki?

A: No, submission of EDI claims is only available for our subscription-based customers.

Q: How long will my enrollments take so that my practice can start submitting claims?

A: For many payers, no EDI enrollments are necessary for sending claims (837P), including Cigna, Aetna, and UHC. However, some payers do require enrollments, which can take up to 30 days or more. Additionally, for ERA (835) enrollments, generally, most payers require enrollments for that type of EDI processing.

Q: What is my role in the enrollment process?

A: Since our customers know their payers best, your role is key to the enrollment process. Once you receive the paperwork from our EDI enrollment team, we do require that you confirm and fill out any necessary EDI enrollments per payer and if it is necessary, forward the documents to each respective payer while forwarding copies to us.